What is a Car Loan? and How to Get a Car Loan?

There are several considerations to weigh when applying for an auto loan. Since there are several auto financing options, shopping around for the best interest rate is essential. You should also be aware that many lenders nowadays provide varying rates and conditions. You should also give serious consideration to your credit rating. Your credit score will heavily influence the interest rate you qualify for. For an accurate estimate of what a vehicle loan would cost you each month, even with a poor credit score, you can utilise a car loan calculator or find a cosigner.

Finally, before you sign the loan agreement, ensure you have a thorough understanding of the terms and circumstances. Read the contract thoroughly, and be sure to clarify any points of confusion with the other party.

How to Get a Car Loan

Getting a car loan should be your first step when looking for a new vehicle. There are a few criteria you must fulfil before you can apply for an auto loan. You'll need a steady income verification, a clean credit report, and a down payment. Many institutions provide auto loans, including traditional banks, credit unions, and internet lenders. Alternatively, you might use the services of a car-loan broker to help you find the most favourable conditions.

Getting the greatest possible interest rate on loan requires looking at rates from many lenders. The monthly instalments for a vehicle loan may be calculated with the aid of a loan calculator.

How to Get a Car Loan With Bad Credit

If you are in need of purchasing a vehicle but have bad credit, it is imperative that you be well-versed on the many alternatives for auto financing that are open to you. Listed below are a few suggestions that may help you get financing. Finding a cosigner should be your first priority. A cosigner is an individual who agrees to be financially responsible for your debt if you cannot do so. Enhancing your credit score is another option. Paying your bills on time, maintaining a positive credit history, and using a credit monitoring service are great ways to do this.

A car loan from a company that specialises in providing loans to people with bad credit would be a last resort. Such loan providers are more likely to approve borrowers with less-than-perfect credit.

How to Get a Car Loan With No Money Down

You should get a car loan if you want a car but don't have enough money to pay it in cash. There are some hoops to jump through before you can get a car loan with no money down. To begin, you should search for a loan provider that doesn't insist on a down payment. Secondly, you need an excellent credit rating. Third, when you buy a car, you should be prepared to make a significant down payment.

In this case, you can get a car loan with no down payment and drive off on your new ride immediately if you meet these criteria.

How to Get the Best Car Loan Interest Rate

The interest rate is a major factor when deciding on a vehicle loan. Getting the lowest possible interest rate on your loan is crucial since it will significantly impact your total repayment costs. You may reduce your car loan's interest rate by completing a few simple actions. Check out the rates offered by several financial institutions beforehand. Check your credit score to see whether everything is in order. You will qualify for a reduced interest rate as your credit score improves.

Finally, it would help if you overcome your reluctance to bargain. You should take advantage of the scenario if you locate a lender prepared to provide a reduced interest rate.

How to Get Out of a Car Loan

Not everyone can afford to keep up with monthly car loan payments. In the current economic climate, you are likely one of the many people in the United States whose car loans are underwater. There are several options for getting out of a car loan in this situation. Alternatives to paying off a car loan include selling the vehicle, refinancing it, or negotiating with the lender.

You should give thorough consideration to the advantages and disadvantages presented by each of your choices before deciding on one. If you're at a loss for what to do next, a financial advisor can help you determine your best course of action.

The Different Types of Car Loans

Several financing avenues are available to those in need of a vehicle's down payment. Loans for automobiles are available from several sources, including banks, credit unions, and online platforms. Dealer financing is another option, although it's not always the smartest move.

It's vital to weigh the benefits and drawbacks of each lender while shopping for a loan. Compared to traditional banks, the interest rates offered by internet lenders are often more competitive. However, it's conceivable that they don't provide the same responsiveness to customers' needs or loan repayment options.

Ultimately, it's up to you to decide which loan best suits your situation. If you want a car loan that works for you, you must look into your alternatives carefully.

What to Look Out for When Getting a Car Loan

The car-buying financing process has a few potential pitfalls. First, you must ensure that you get a loan from a reputable lender. The world is full of con artists waiting to grab your money.

Second, make sure you know everything there is to know about the loan. Before you agree to the loan, you should ensure you are happy with the interest rate, the plan for paying it back, and other terms and conditions. Carefully read the terms and conditions.

Finally, look around to see what the greatest bargains are. Don't jump at the first loan offer you get. Check with many loan providers to compare rates before making a final decision.

Conclusion

After doing some research online, the first step in the application process for a car loan is to choose the most reputable lenders; the second step is to look around for the most favourable interest rate; the third step is to complete the appropriate paperwork. Your credit score may take a hit if you take out a loan, but if you don't pay it back on time, it might hurt your score. If all payments are done on time, then there will be no need to worry about the situation.

Related Posts

What is a Home Appraisal? and Why Do You Need One?

What is a Hedge Fund and How to Invest in It

What is a Balance Transfer?

What Is a Meme Stock?

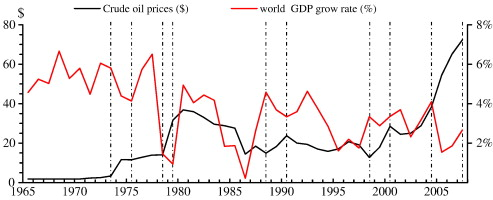

What Causes Oil Prices to Fluctuate?